How knowing the amortization definition supports smarter property investing

Knowing the basics of property investing is critical, but fewer investors take the time to learn how key financial concepts like amortization can shape their strategies and results. Understanding the definition of amortization definition not only clarifies the long-term costs and benefits of owning property but also unlocks a range of opportunities for making data-driven decisions that can protect and grow your investment.

Whether you’re buying your first property or growing a real estate portfolio, exploring the mechanics of amortization can change the way you evaluate deals, forecast profits, and manage your finances. This article explores how grasping this essential term positions property investors to stay ahead of the curve and maximize their returns.

What Is Amortization, and Why Does It Matter?

At its core, amortization refers to the process of gradually paying off a debt over a specified period with regular payments. For real estate investors, amortization typically describes how a mortgage loan is repaid through equal payments that cover both interest and principal. Each month, a portion of your payment goes toward lowering the balance you owe (the principal), while another portion covers the interest charged by the lender.

This isn’t just an accounting term; it’s a powerful strategy tool that reveals exactly how much you’re paying in interest versus building actual equity in your property over time. When you understand amortization schedules, you can see the full picture of how your money works throughout the life of a loan.

Data-Driven Analysis for Every Investment

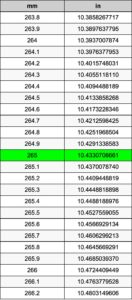

Property investors leverage numbers at every step. If you know how amortization works, you can analyze how various loan structures, terms, and interest rates impact the total cost of a property. For example, reviewing an amortization table enables you to compare a 15-year loan with a 30-year loan visually. You’ll immediately see that while shorter terms mean higher monthly payments, they reduce the total interest you’ll pay by tens of thousands of dollars.

Data shows that early in most loans, a larger share of each payment goes to interest, while later payments contribute more to the principal. Recognizing this pattern lets you track when your equity begins to grow most rapidly and even spot opportunities for refinancing or early payoff.

Cash Flow Forecasting and Portfolio Planning

Smarter investors use amortization knowledge for more than just a single purchase. Understanding amortization means accurately forecasting cash flow needs, project outflows, and knowing when you’ll hit key financial milestones. With detailed amortization projections, you can plan for:

- When major equity will be unlocked in a property (useful for further investment or securing additional loans)

- The true cost of borrowing, including any prepayment penalties or savings from accelerated payments

- Opportunities to rebalance your portfolio by selling or refinancing high-equity properties to fund new investments

Historic market data suggests that investors who leverage amortization statistics in their forecasts are better equipped to weather fluctuations in interest rates and property values, adapting strategies before market shifts affect their bottom line.

Equity Building Strategies

One significant benefit of understanding amortization is the insight it provides into how and when property equity builds up. Equity is the value of your property minus what you still owe on your mortgage. Over time, as regular payments reduce your loan balance, your share of ownership grows—even if the property market stays steady.

Post Comment